Service

Customers separating from their partner must manage their financial separation amidst emotionally difficult times. For this, the customer visits the bank and starts the process by filling paper work and providing required documents.

Problem Statement

As the financial separation process is only available at the bank, it is restrictive and tedious for the customers. To overcome this problem, it is important to identify digital touch points through various digital channels. This will make the process digitally accessible to the customers and reduce dependency on bank branch employees.

My role

Medior UX Designer

Project duration

6 months

Team

Design lead, Tech lead, Product owner, Product manager

Collaborators

Other designers, Program manager, Stakeholders from multiple departments

Process

The design process was mainly focused on research and design phases. The findings, insights and opportunities were documented in a report a with recommendations for the next steps.

Customer research

After some surveys and customer interviews; the current process was analysed and some issues were identified.

Pains

-

Paper based application

-

No progress tracking

-

No periodical updates

-

Frustration due to lack of guidance

-

Difficult process

-

Manual process

-

Difficult to reach advisor

-

Need to visit the bank for everything

-

Miscommunication

-

Lack of guidance

Needs

-

Multiple digital touch points

-

Periodic updates

-

Digital tracking system

-

Different channels of communication

-

Easy and intuitive process

-

Dedicated advisor

-

Avoid filling multiple forms

-

Self-service ability

-

Customer control

-

Improved customer support

Stakeholder workshops

Stakeholders from multiple departments participated in these workshops. The discussions gave an overview of each department's role and inter-dependency for some processes.

Service blueprint

Based on research and various workshops with different teams, a new service flow was designed.

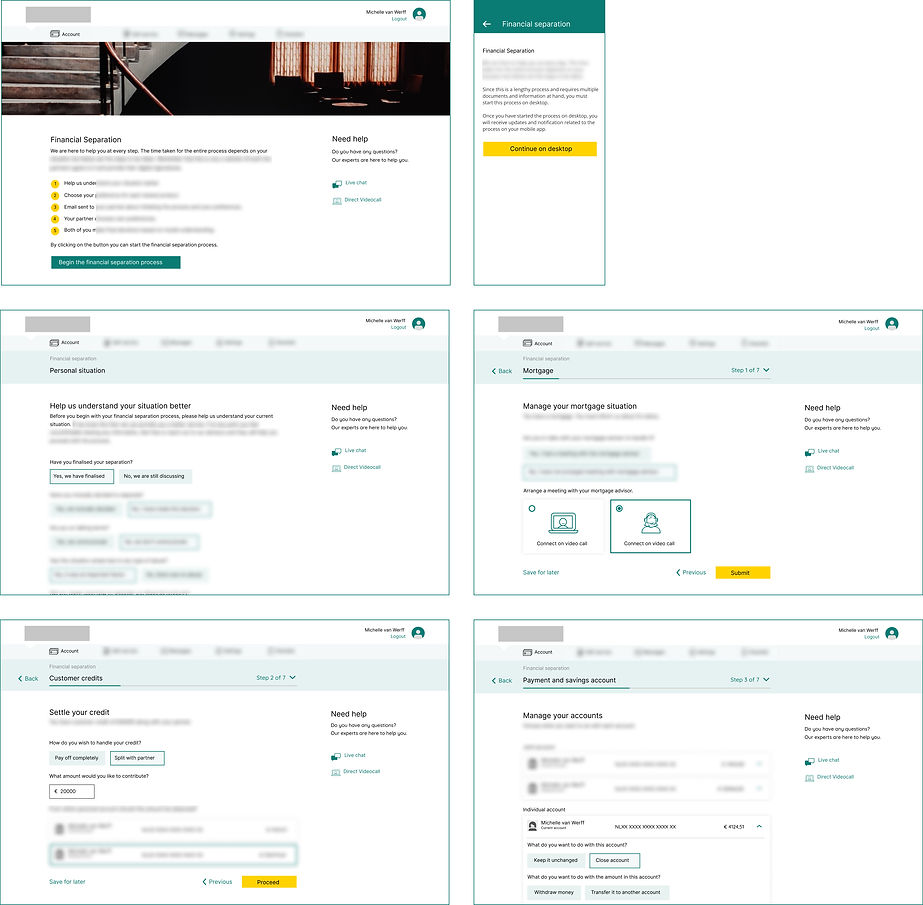

Wireframes (high-fidelity)

The designs were made using the design system components and patterns. A decision was made that since this workflow is highly critical, the initial phase of application must be only available on the desktop. But the notification and tracking after the initial application will be available on all devices.

Usability study

The usability team comprised three members. Everyone was assigned a task which ensured that the task was conducted in the best possible manner to achieve the research objective.

Co-ordinator

Ensured that the participant,

-

understood the format of the study

-

had required device, internet connection and signed the NDA

-

was comfortable to proceed

Communicator (myself)

Conducted the study by,

-

explaining the purpose of the study

-

providing the task, sharing the prototype link, setting timer

-

ask the follow-up questions

Note taker

A silent observer, who

-

took detailed notes

-

observed participants body language and interaction patterns

-

if needed, asked followup question

Research objective

-

Understand the customer’s willingness to digitally initiate the process and proceed with it

-

Observe how often the customer feels the need for more information and considers contacting the bank

-

Overall experience of the initial workflow

Research set-up

-

The test allotted 15 minutes for each participant and was conducted remotely through Microsoft Teams due to the corona restrictions

-

The task took 10 mins to complete followed by 5 mins for task specific questions and participant feedback

-

Participants were provided with a task and a Figma prototype link

-

Participants were between the age group of 35 and 60 years. They were of mixed gender and all of them had average or above digital skills

-

Before the participants started they were asked about their comfort level to talk about their separation experience

Study findings

Some of the findings from the usability study are mentioned below. The overall observations and findings were valuable in planning the next steps.

" In digital, one can make wrong decision. But if you talk to someone, you get to know more possibilities."

" It’s difficult to make decisions without having an overview of all my assets associated to all accounts. "

" Flow is so simple. But divorce is a complex process. The whole world is not only ‘Yes’ and ‘No’. "

Skeptical about the digital system

All participants were comfortable with using the digital interface. But when it came to the workflow they were concerned and did not feel comfortable to use it. They needed assurance at every stage that whatever they choose was a wish list and nothing was finalised yet.

Accounts with multiple banks

Some participants had accounts with multiple banks. They wanted to know if they could link those accounts and look at their finances holistically. This would help them in making more informed choices and reduce chances of error.

Customer situation questionnaire

Participants were comfortable answering them but found the Yes and No options restrictive. They felt the questions were insufficient to understand their entire situation. For few questions, they wanted a space to type detailed explanation.

Design improvements

Based on feedback some updates were made in the service blueprint, workflows and components. Some of the design updates are mentioned below.

Report and recommendations

Based on the findings from research, workflows from service blueprint and insights from usability study; a report was documented to outline the recommended approach and design decisions to be considered for the next steps. Some of the important pointers from the report are mentioned below. The service blueprint was valuable for cross-departmental communication.

Digital tracking

Customers are extremely happy and comfortable with the idea of receiving regular updates of the process. The digital tracking system reduced the overall frustrations and ambiguity in the process. And having multiple digital touch points positively contribute in the transformation of the service into a digitally enabled service.

Advisor touchpoints

The entire process has high emotional stake. Customers don’t trust the digital touch points for such processes. There are multiple decisions within the flow which can be biased by emotions. Hence it is advisable to assign an advisor from the beginning of the process. This will ease the tension and compliment the digital flow.

Need for research

The entire service flow needs to be improved based on information gathered during the usability testing. There is a need to conduct in depth research to identify trust gaps in an emotionally sensitive digital service. This will not only help this particular service but will also drive trust growth initiatives across the platform. With increasing number of digital services, it is important to focus on customer trust.